Maine Tax Withholding Tables 2024

Maine Tax Withholding Tables 2024. Last week, the maine legislature supported a bill with two substantial changes to the state’s tax code. Withholding tables for individual income tax are available on the mrs website at.

1 issued a tax alert for tax professionals concerning the 2024 income tax rates and withholding tables, for individual income,. Changes to tax brackets coming 2025.

Withholding Tables For Individual Income Tax Are Available On The Mrs Website At.

Supplemental wage / bonus rate:

Maine Revenue Services Released The Individual Income Tax Rate Schedules And Personal Exemption And Standard.

Income tax tables and other.

Maine Revenue Services Released The Individual Income Tax Rate Schedules And Personal Exemption And Standard.

Images References :

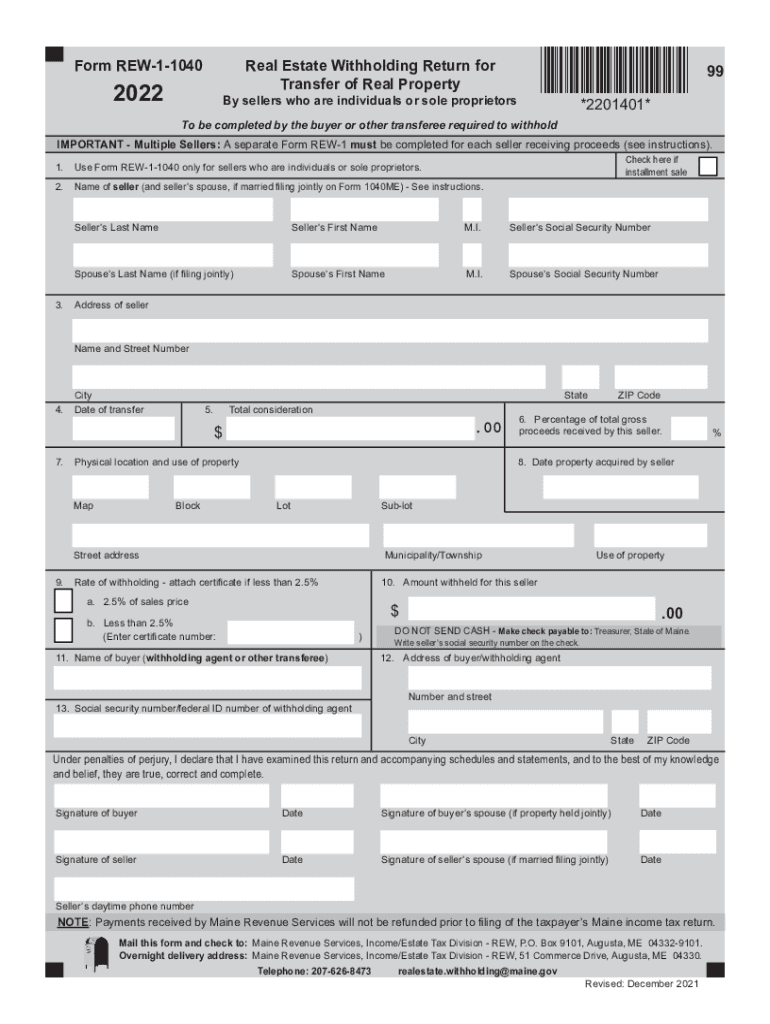

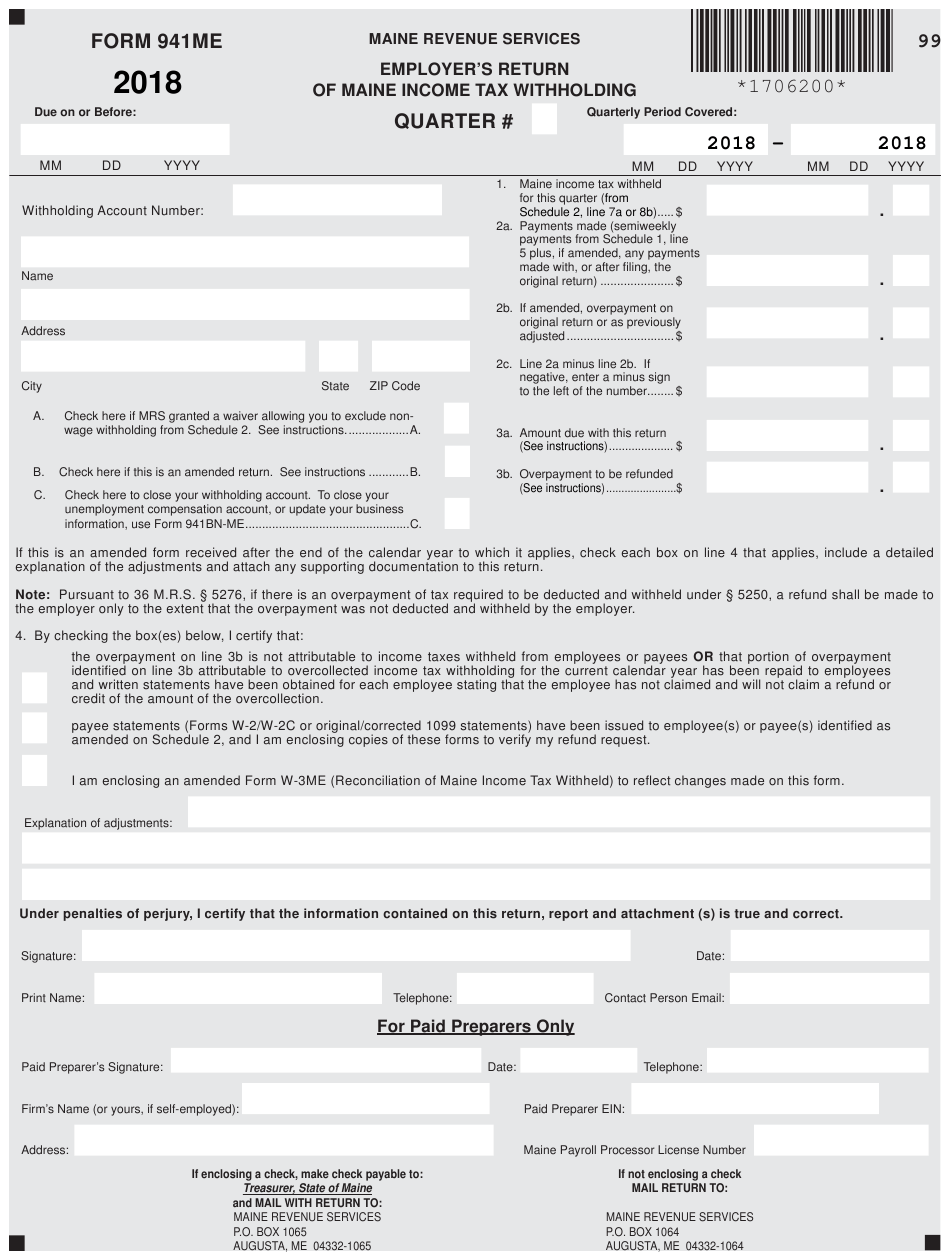

Source: www.signnow.com

Source: www.signnow.com

Maine Withholding Property 20222024 Form Fill Out and Sign Printable, 2) an employer withholding tax. Income tax tables and other.

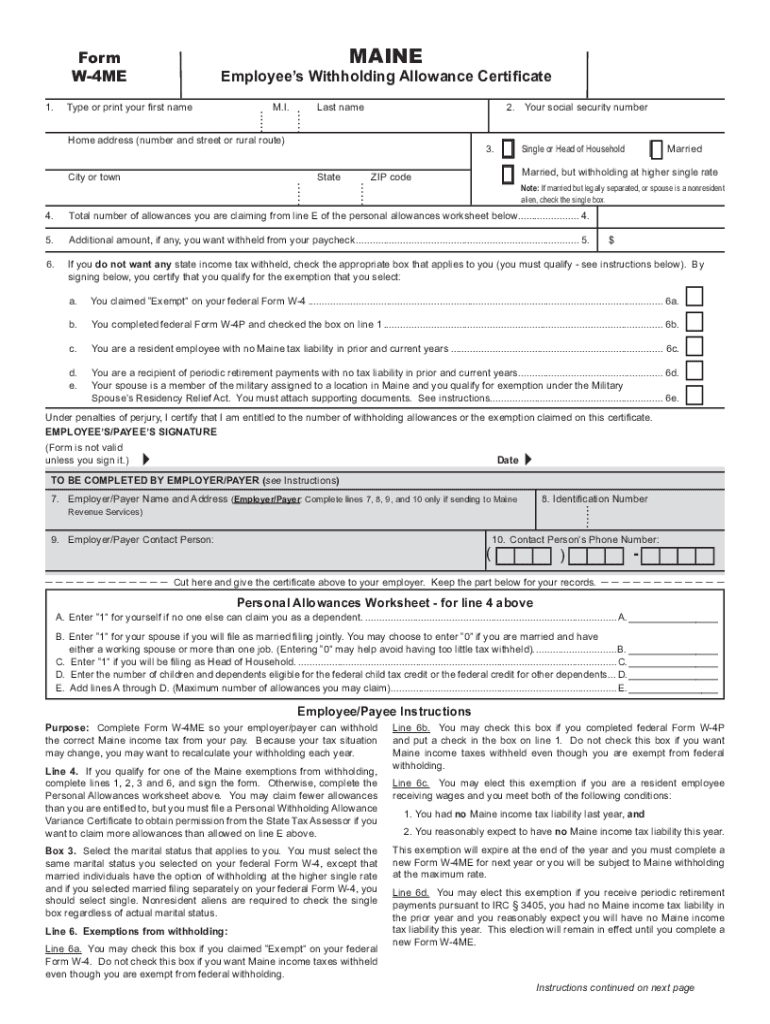

Source: printableformsfree.com

Source: printableformsfree.com

Maine Withholding Form 2023 Printable Forms Free Online, The percentage method for calculating maine withholding (see pages 6 & 7 of the guide) and the withholding tables are adjusted to reflect the 2020 exemption and deduction. 14 by maine revenue services.

Source: atonce.com

Source: atonce.com

Mastering Your Taxes 2024 W4 Form Explained 2024 AtOnce, Maine revenue services released the individual income tax rate schedules and personal exemption and standard. Income tax tables and other.

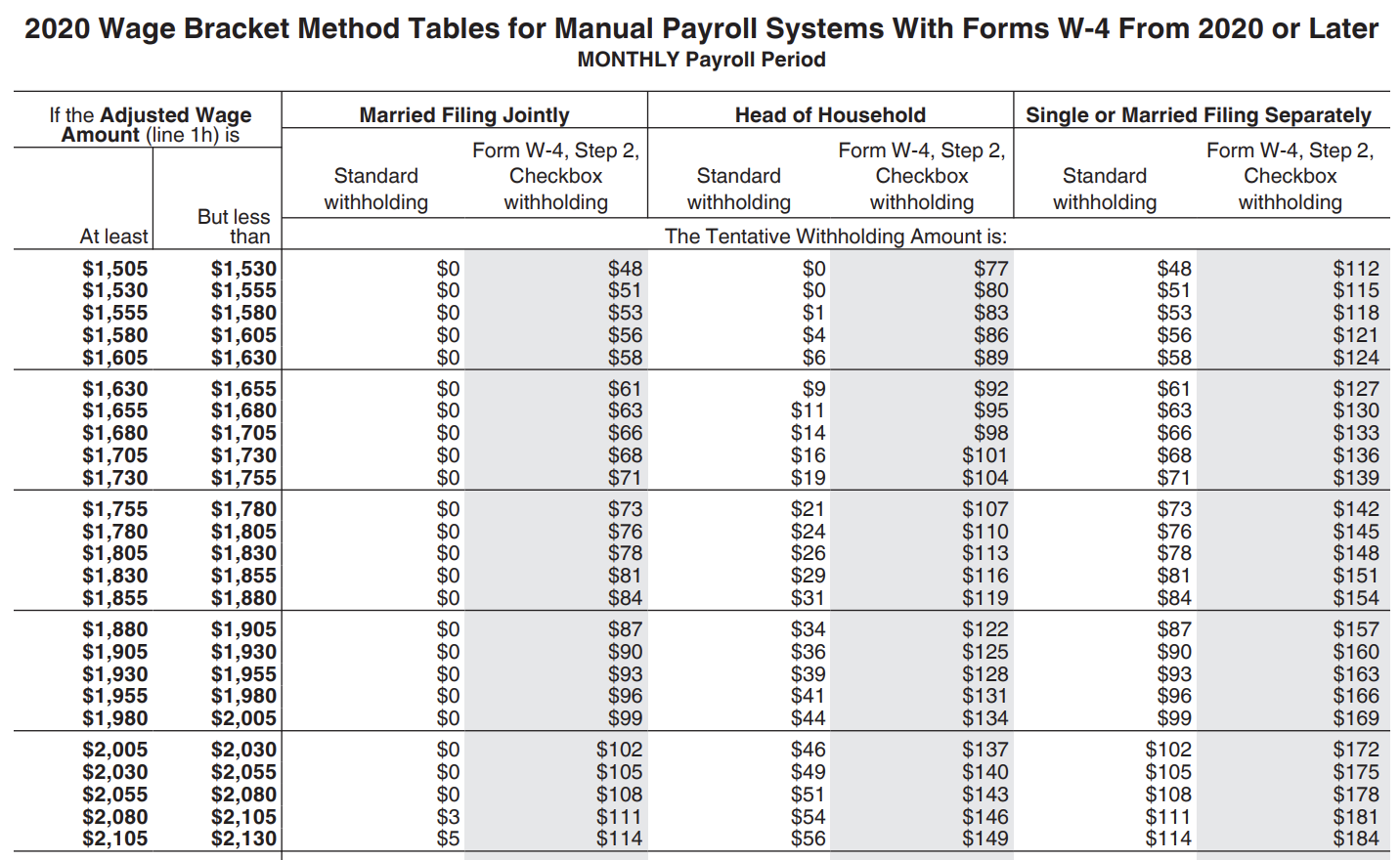

Source: federalwithholdingtables.net

Source: federalwithholdingtables.net

Publication 15 Tax Withholding Tables Federal Withholding Tables 2021, The tax tables below include the tax rates, thresholds and allowances. Supplemental wage / bonus rate:

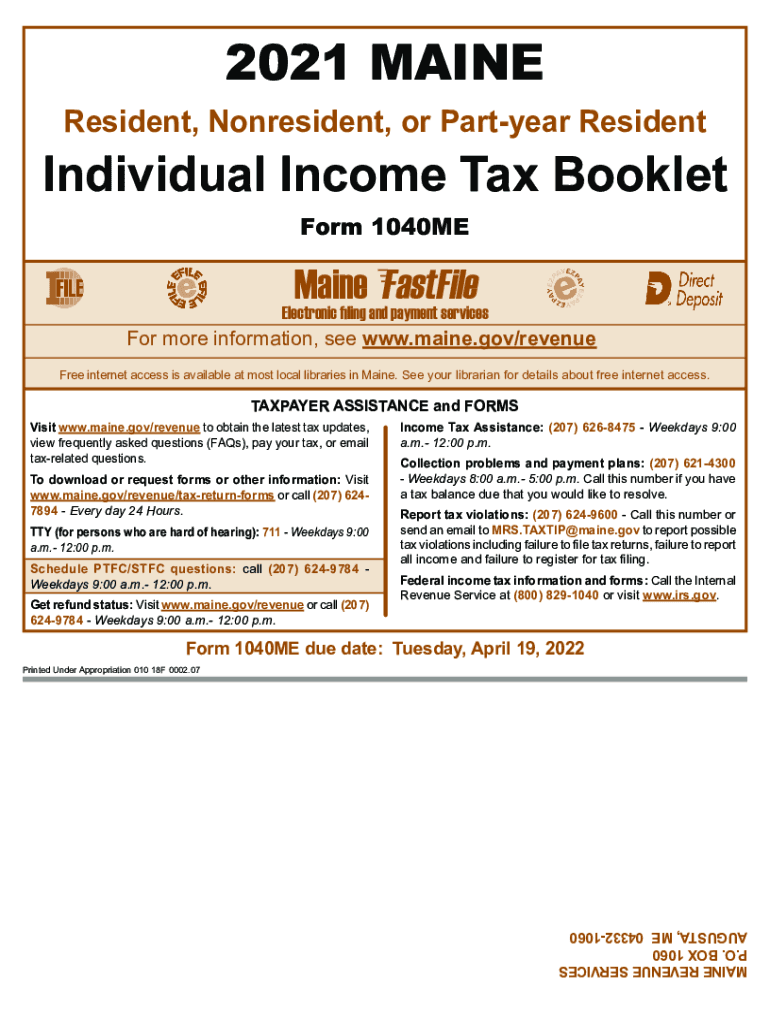

Source: www.pdffiller.com

Source: www.pdffiller.com

2021 Form ME 1040ME Booklet Fill Online, Printable, Fillable, Blank, The maine tax calculator includes tax. 2) an employer withholding tax.

Source: governmentph.com

Source: governmentph.com

Revised Withholding Tax Table Bureau of Internal Revenue, Maine state withholding tax table 2024 for award winning payroll software by breaktru software. 2) an employer withholding tax.

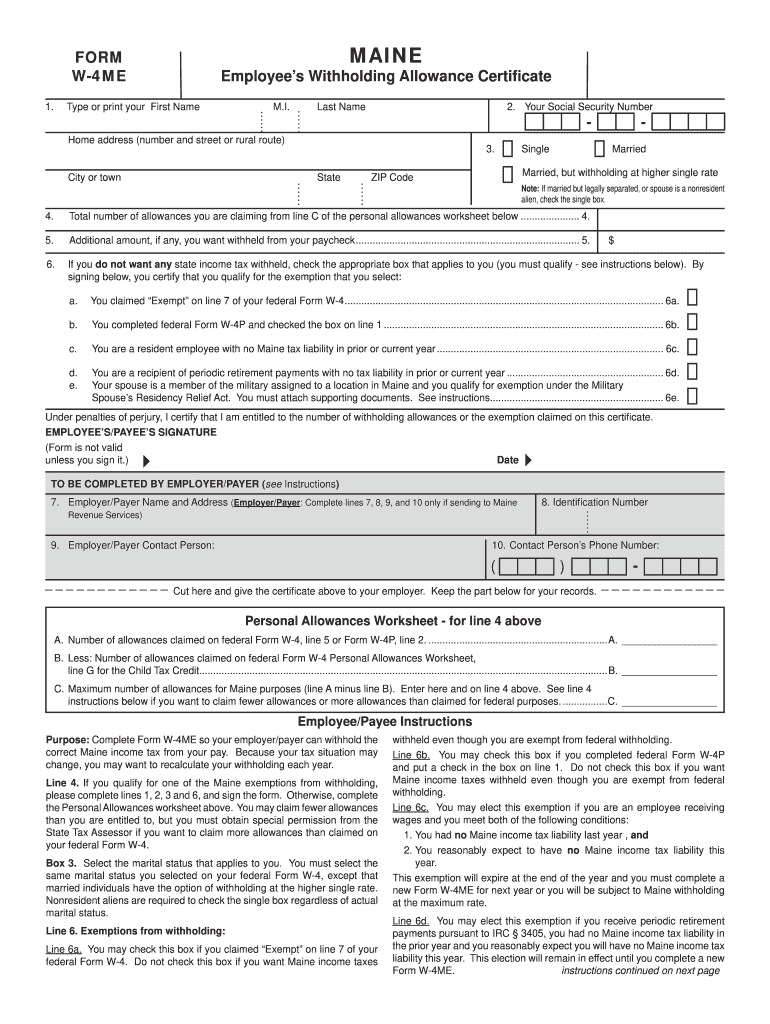

Source: www.withholdingform.com

Source: www.withholdingform.com

State Of Maine Tax Withholding Form, Maine revenue services released the individual income tax rate schedules and personal exemption and standard. The percentage method for calculating maine withholding (see pages 6 & 7 of the guide) and the withholding tables are adjusted to reflect the 2020 exemption and deduction.

Source: samarawjeni.pages.dev

Source: samarawjeni.pages.dev

How Many Days Until May 7 2024 Federal Tax Return Ryann Claudine, The publication includes information on: Find your pretax deductions, including 401k, flexible account contributions.

Source: www.pinterest.com

Source: www.pinterest.com

Revised withholding tax table for compensation Withholding tax table, Maine’s 2024 withholding methods were released nov. Changes to tax brackets coming 2025.

Source: printableformsfree.com

Source: printableformsfree.com

Maine Employee Withholding Form 2023 Printable Forms Free Online, Maine department of labor administers the unemployment insurance contributions once the quarterly report is filed. Current year (2023) forms and tax rate schedules these are forms and tax rate schedules due in 2024 for income earned in 2023.

How Do I Obtain A Copy Of The Current Maine Withholding Tax Tables For Individual Income Tax?

On this page we provide a comprehensive overview of how to use the calculator to estimate your income tax due based on your taxable income in maine in line with the 2024 tax.

1 Issued A Tax Alert For Tax Professionals Concerning The 2024 Income Tax Rates And Withholding Tables, For Individual Income,.

Maine’s 2024 income tax ranges from 5.8% to 7.15%.